Future-Proofing Your Business & Wealth in 2025:

Strategic Insights from JF Bicking & Co. and Pallas Wealth Management

Introduction

2025 is around the corner, and the business and financial landscapes are evolving rapidly. With advancements in technology, shifting market conditions, and increasing competition, organizations and individuals must adopt proactive strategies to secure their future. This light paper outlines essential steps to prepare for 2025, including goal setting, technology adoption, wealth preservation, and M&A opportunities.

1. Strategic Goal Setting for 2025

Aligning Actions with Long-Term Objectives

Why It’s Crucial

Clear, achievable goals serve as the cornerstone of strategic planning. Without them, businesses risk drifting aimlessly, while individuals might miss key financial milestones.

Key Steps

Define SMART Goals: Ensure your objectives are Specific, Measurable, Achievable, Relevant, and Time-bound.

Align Short-Term and Long-Term Plans: Immediate actions should build toward overarching objectives.

Review and Adjust Regularly: Set quarterly or semi-annual check-ins to refine goals based on progress and market conditions.

Real-World Example

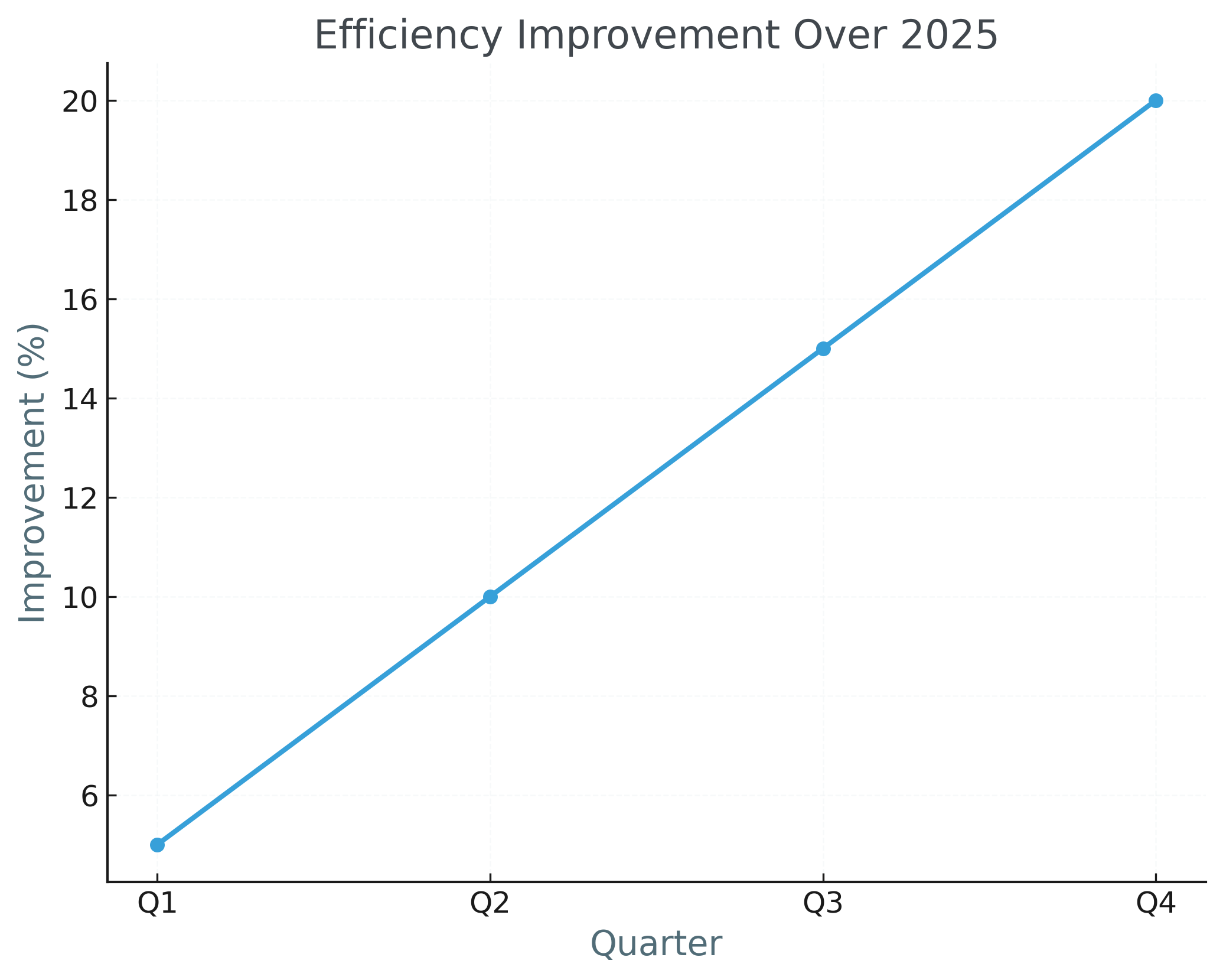

A mid-sized manufacturing firm partnered with JF Bicking & Co. to develop a roadmap targeting a 20% efficiency improvement by 2025. Through careful planning and ongoing evaluations, the company achieved this while reducing operational costs.

Actionable Tip

Identify one key metric per department to focus on in 2025 and align it with your company’s broader mission.

2. Leveraging Technology for Innovation

Harnessing AI, Automation, and Digital Tools

Why It’s Crucial

Technology drives competitive advantage, enabling companies to streamline operations, uncover insights, and deliver value faster.

Key Steps

Adopt AI for Decision-Making: Use AI to analyze trends, predict market changes, and enhance customer experiences.

Automate Routine Processes: Free up resources by automating repetitive tasks.

Invest in Cybersecurity: Ensure digital transformation efforts are secure from threats.

Real-World Example

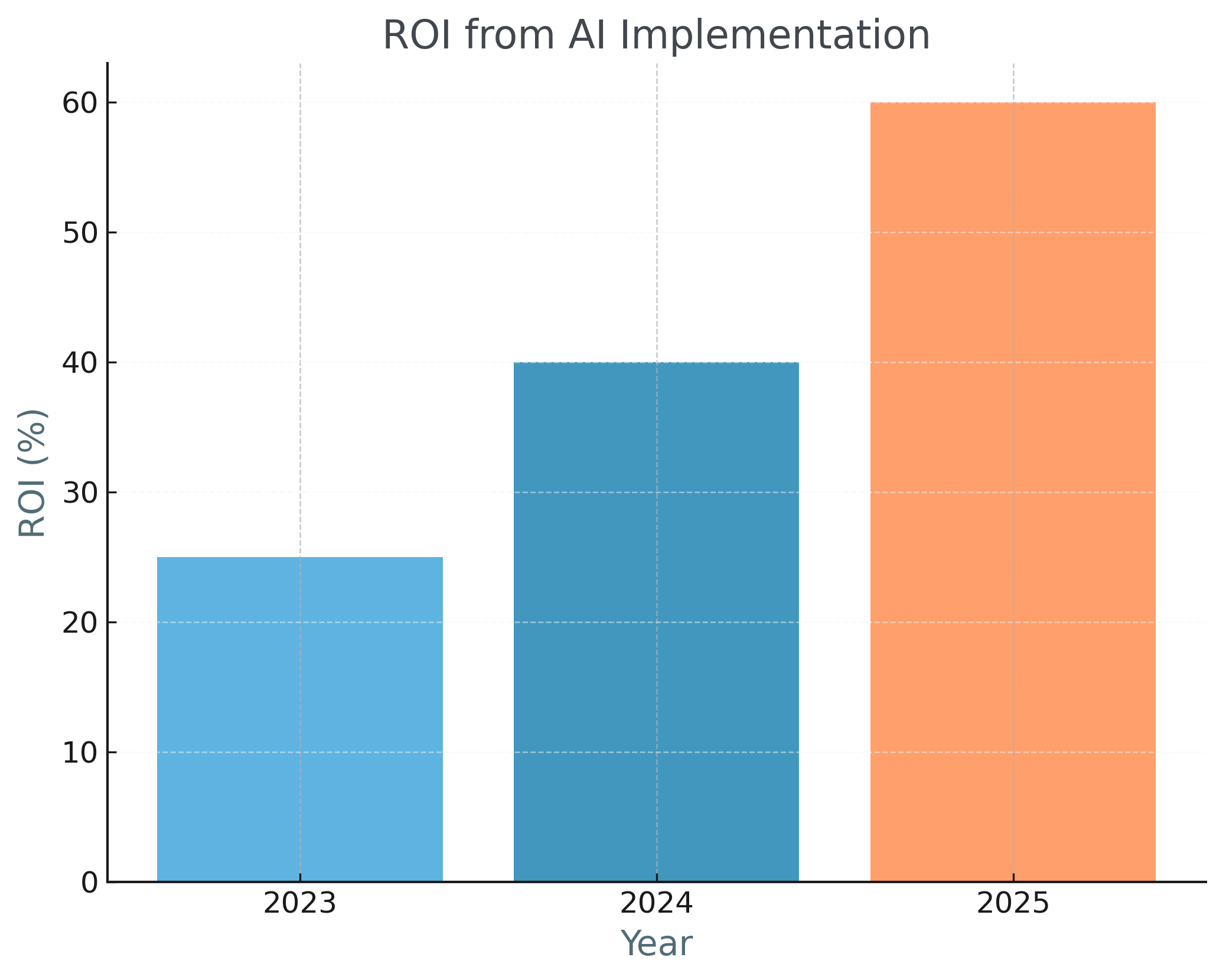

A retail business integrated AI analytics with the help of JF Bicking & Co. to forecast demand more accurately, reducing inventory costs by 15% while improving customer satisfaction.

Actionable Tip

Identify one area of your operations where automation can save time and start implementing it in Q1 2025.

3. Wealth Preservation and Growth

Strategies to Minimize Taxes and Build Wealth

Why It’s Crucial

Wealth management in 2025 requires more than just growing assets; it’s about protecting them from market volatility and tax burdens.

Key Strategies

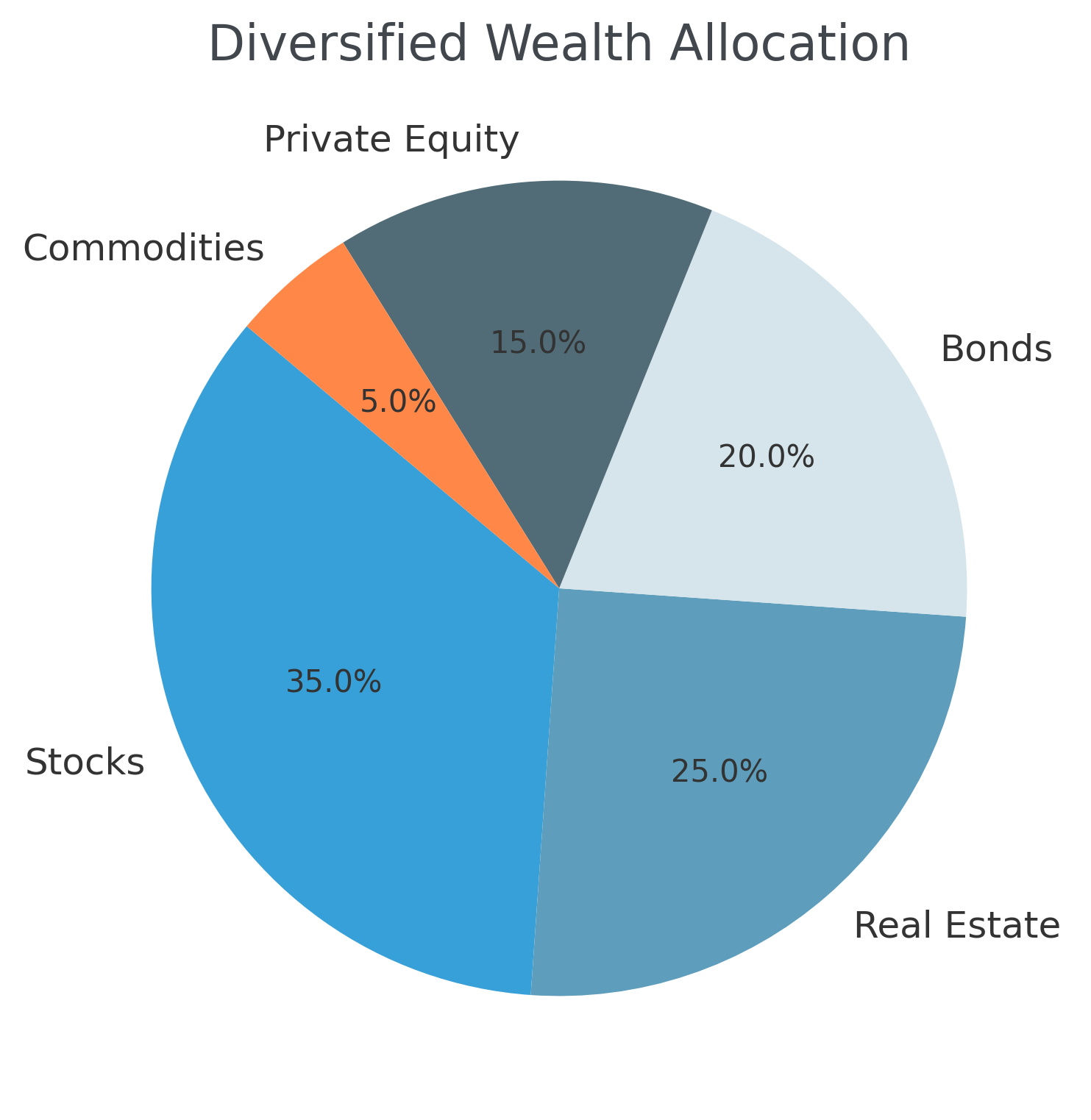

Diversify Investments: Spread assets across classes to balance risk and reward.

Optimize Tax Efficiency: Leverage tax-advantaged accounts and gifting strategies.

Pursue Sustainable Growth: Align investments with personal values for long-term impact.

Real-World Example

Pallas Wealth Management guided a family-owned business through a portfolio diversification strategy that reduced exposure to high-risk assets while achieving steady annual returns of 8%.

Actionable Tip

Review your investment portfolio before year-end and rebalance to align with market trends and your goals.

4. Seizing Opportunities Through M&A

Unlocking New Growth in Competitive Markets

Why It’s Crucial

Mergers and acquisitions offer businesses a way to accelerate growth, expand capabilities, and enter new markets.

Key Strategies

Identify Strategic Partners: Look for complementary businesses that align with your long-term vision.

Conduct Thorough Due Diligence: Evaluate potential risks and rewards carefully.

Plan Post-Merger Integration: Ensure smooth transitions to maximize value.

Real-World Example

A tech startup worked with JF Bicking & Co. to acquire a smaller competitor, gaining market share and new intellectual property. The acquisition was completed seamlessly, boosting revenue by 25% within a year.

Actionable Tip

Host an internal strategy session to identify potential acquisition opportunities in your industry.

Conclusion

The year 2025 presents an opportunity for businesses and individuals to future-proof their strategies. By setting clear goals, leveraging technology, preserving wealth, and exploring M&A opportunities, you can build a resilient foundation for success.

At JF Bicking & Co. and Pallas Wealth Management, we are committed to guiding our clients through these steps with expertise and personalized support. Let’s work together to make 2025 your most successful year yet.

Connect with JF Bicking & Co. or Pallas Wealth Management today to start your 2025 planning. Together, we’ll design a strategy that ensures growth and security for years to come.