Strategic Innovation and Capital Management

Key Drivers of Sustainable Growth for Businesses and High-Net-Worth Individuals (HNWIs)

Introduction

In today’s fast-paced and rapidly evolving global economy, businesses and high-net-worth individuals (HNWIs) are increasingly discovering that traditional strategies alone are insufficient for sustained growth and long-term success. The demands of navigating volatility, leveraging technological advancements, and responding to growing concerns around sustainability have heightened the importance of strategic innovation and dynamic capital management.

JF Bicking & Co. and Pallas Wealth Management are positioned at the forefront of these shifts. JF Bicking & Co.’s strategic advisory services, combined with Pallas Wealth Management’s tailored wealth management expertise, form a cohesive approach to helping businesses and HNWIs thrive. Whether through mergers and acquisitions (M&A), digital transformation, or innovative investment strategies, these firms deliver results that ensure clients can navigate complex environments and seize emerging opportunities.

This light paper explores the key roles of innovation and capital management as pillars of long-term growth, examining their influence across various areas: business development, wealth preservation, and socially responsible investment. The aim is to highlight how these drivers enable businesses and HNWIs to create sustainable value, preserve wealth, and make a lasting positive impact in the modern economic landscape.

Innovation as a Growth Driver: Digital Transformation and Beyond

The Necessity of Innovation in Modern Business Strategy

In the digital era, businesses must embrace continuous innovation to maintain competitiveness and relevance. Technological advances such as artificial intelligence (AI), machine learning, data analytics, and cloud computing are no longer optional—they are core elements of strategic business planning. Those businesses that successfully integrate these innovations into their operations can unlock new growth pathways and improve their efficiency.

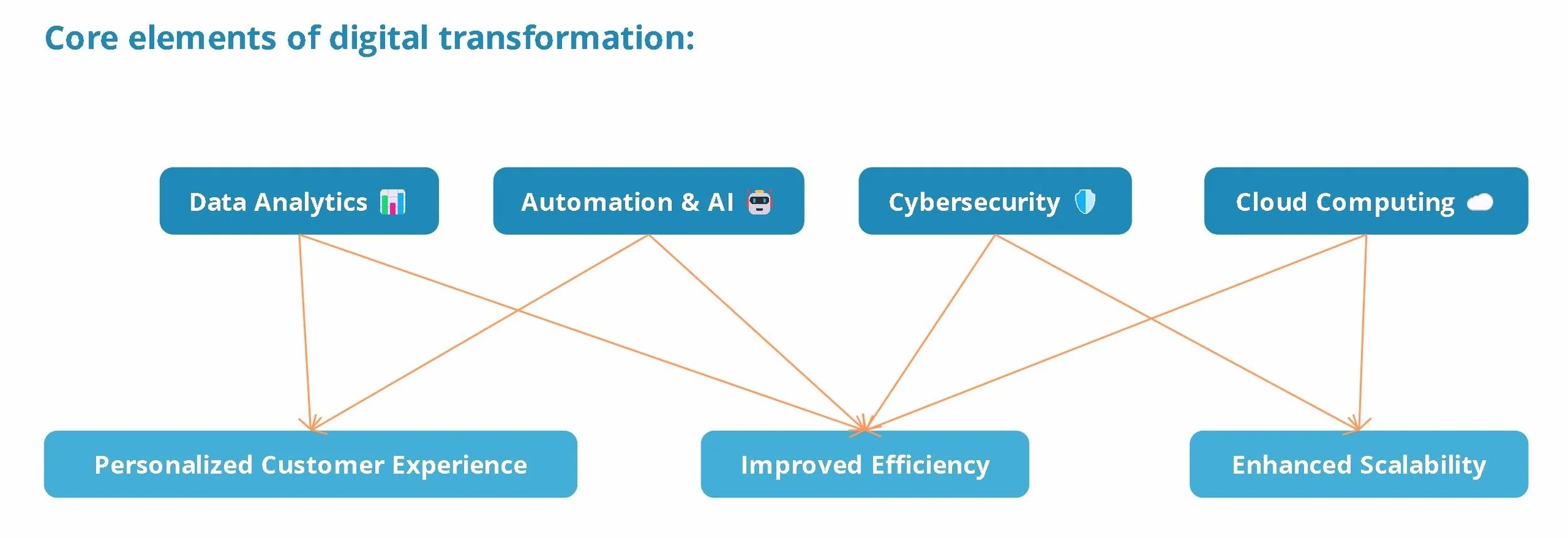

Critical Areas of Digital Transformation:

Artificial Intelligence (AI) and Automation: AI and automation allow businesses to streamline operations, increase productivity, and reduce human error. AI also offers advanced data analytics capabilities, providing companies with insights to make more informed, predictive decisions. Businesses that leverage AI can forecast market trends, optimize supply chains, and enhance customer experiences through personalized services.

Cloud Computing: Cloud technology provides businesses with the flexibility to scale operations as needed, reducing costs associated with IT infrastructure while ensuring seamless collaboration across global teams. Additionally, cloud platforms enable businesses to access vast amounts of data in real-time, enhancing decision-making processes.

Data Analytics and Big Data: Access to data is vital in today’s business world. The ability to gather, process, and analyze data in real-time allows businesses to identify patterns and trends, tailor offerings to customer preferences, and optimize internal processes.

Cybersecurity: As businesses become more digitally integrated, the need for robust cybersecurity measures is paramount. Protecting sensitive data, preventing breaches, and safeguarding intellectual property have become crucial for maintaining customer trust and long-term business success.

The Strategic Benefits of Innovation:

Operational Efficiency: Automation and AI can reduce redundancies and streamline processes, ultimately increasing profitability.

Customer-Centric Models: Digital tools allow for more personalized customer interactions, which can enhance customer loyalty and increase customer lifetime value.

Scalability and Agility: Cloud technologies enable businesses to expand rapidly without incurring significant infrastructure costs, allowing them to remain agile in a competitive market.

Companies that effectively integrate these technologies into their business models are positioned to thrive, while those that fail to innovate risk falling behind.

Mergers and Acquisitions: Expanding Through Strategic Growth

M&A as a Pathway to Competitive Advantage

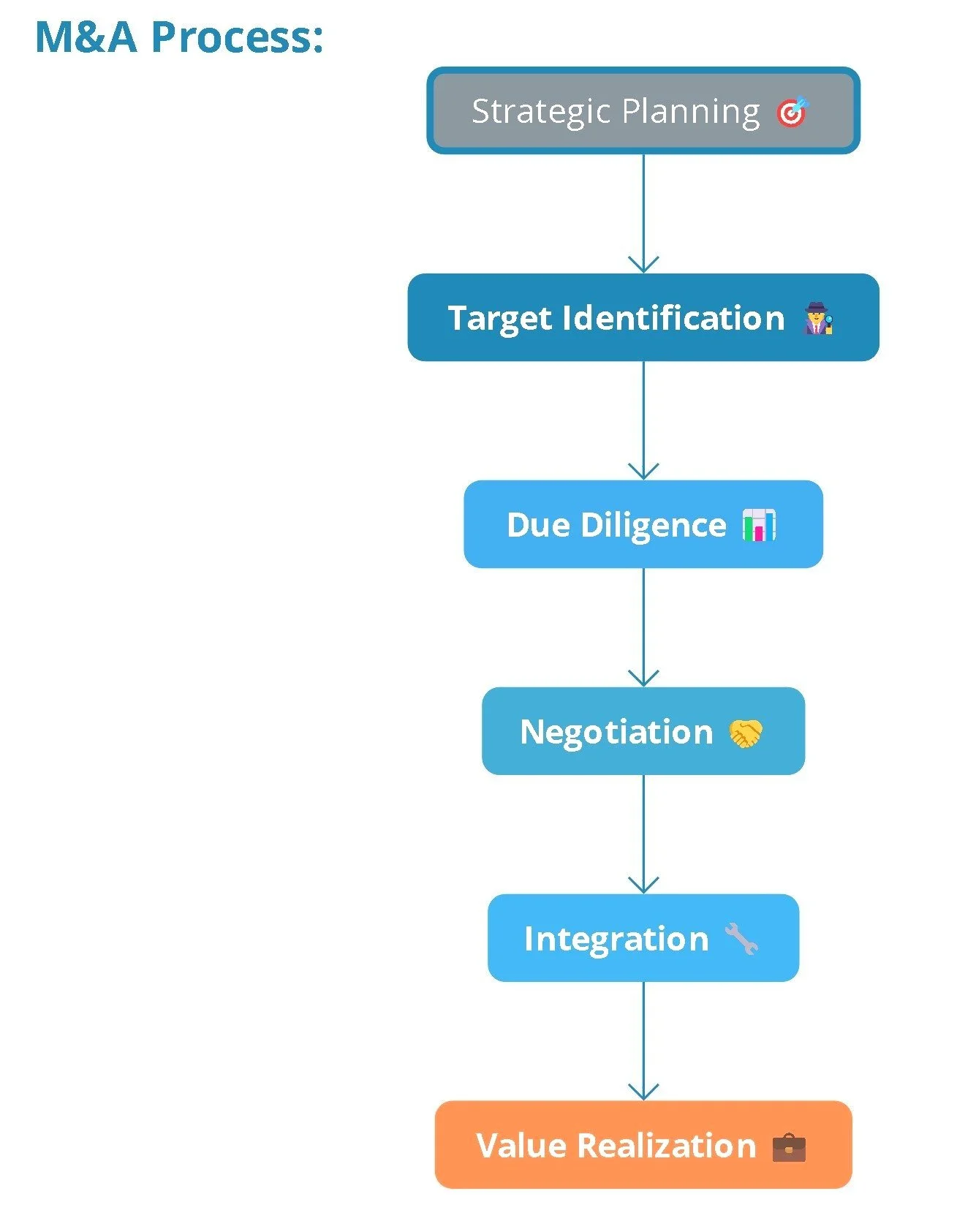

Mergers and acquisitions (M&A) have long been a tool for businesses to achieve growth, expand into new markets, and gain access to new technologies and talent. Whether motivated by the need to diversify, acquire technological capabilities, or increase market share, M&A activity is critical to the long-term success of many businesses.

Key Drivers of M&A:

Market Expansion: M&A allows businesses to quickly enter new markets or geographic regions, bypassing the hurdles associated with organic growth. By acquiring an existing player in the market, businesses gain immediate access to established customer bases, distribution channels, and brand recognition.

Technological Integration: Many businesses engage in acquisitions to incorporate cutting-edge technologies or intellectual property that would be costly or time-consuming to develop internally. Technology-driven M&A can provide a competitive edge by enabling the acquirer to innovate more quickly and efficiently.

Economies of Scale: One of the core reasons for M&A is to realize synergies and achieve economies of scale. By combining operations, companies can reduce overhead costs, improve operational efficiency, and strengthen their market position.

Risk Diversification: For businesses operating in a volatile market, M&A provides opportunities to diversify product offerings, customer bases, and revenue streams, thereby mitigating risk.

Challenges in M&A and the Importance of Strategic Advisory:

While the potential benefits of M&A are significant, the process is fraught with challenges that can derail even the most promising deals. Common pitfalls include cultural integration issues, regulatory hurdles, and poorly executed post-acquisition integration plans. Businesses that engage in M&A without adequate preparation and expert guidance risk failure.

Strategic advisory services, like those offered by JF Bicking & Co., play a critical role in overcoming these challenges. From the early stages of deal sourcing to the final integration of acquired assets, experienced advisors provide insight into valuation, negotiation, and integration strategies. This support helps businesses maximize the value of their acquisitions and ensure successful outcomes.

Capital Management: Preserving and Growing Wealth for HNWIs

Tailored Wealth Management Strategies

For high-net-worth individuals (HNWIs), capital management is about more than accumulating wealth; it is about protecting that wealth across generations while seizing opportunities for growth. Effective capital management involves developing customized strategies that take into account the specific goals, risk tolerance, and time horizons of the individual.

Key Components of Wealth Preservation:

Diversified Portfolios: Diversification is essential for reducing risk and achieving long-term financial stability. HNWIs often invest across various asset classes—including equities, fixed income, real estate, and alternative investments—tailored to their financial goals. By spreading assets across different sectors and geographies, they can protect their portfolios from downturns in any one area.

Risk Management: A critical aspect of wealth preservation is managing risk through hedging strategies and tactical asset allocation. This can involve allocating assets in a way that minimizes exposure to volatile sectors while optimizing returns.

Tax Efficiency: Preserving wealth involves structuring investments to minimize tax liabilities. Pallas Wealth Management employs tax-efficient strategies, such as charitable donations, trusts, and estate planning, to protect assets from excessive taxation and ensure the smooth transfer of wealth across generations.

Liquidity Management: Maintaining a balance between liquid and illiquid assets allows HNWIs to remain agile in responding to both market opportunities and immediate financial needs.

Estate and Succession Planning: For HNWIs, passing wealth to the next generation in an orderly and tax-efficient manner is a critical concern. Estate planning and wealth succession strategies ensure that financial legacies are preserved, with minimal tax impact on heirs.

Wealth Growth in Uncertain Markets:

Navigating volatile financial markets requires an approach that balances risk and reward. With market conditions in constant flux, Pallas Wealth Management tailors its investment strategies to suit each client’s unique circumstances, ensuring that wealth is not only preserved but also grown over time.

Impact and Value Investing: Aligning Financial Goals with Social Responsibility

The Growing Trend of ESG and Sustainable Investment

As societal values shift, so do the investment strategies of both individuals and institutions. Environmental, Social, and Governance (ESG) criteria have become a significant factor in the decision-making process for both businesses and HNWIs. Impact investing, which aims to generate both financial returns and positive social outcomes, has surged in popularity as investors seek to align their financial objectives with their personal values.

What is ESG Investing?

ESG investing refers to the practice of incorporating environmental, social, and governance factors into investment decisions. This could involve investing in companies with strong environmental policies, good labor practices, or transparent governance structures. ESG criteria help investors identify companies that not only offer financial growth but also contribute to a better world.

Benefits of Impact and ESG Investing:

Long-Term Financial Gains: Studies have shown that companies with strong ESG profiles are more likely to achieve sustainable long-term growth. By mitigating risks associated with environmental and social issues, these companies are better positioned to withstand market shocks.

Social Impact: Investors increasingly want their capital to contribute to positive social and environmental change. ESG and impact investing provide a framework for investors to align their wealth with their personal values.

Attracting Talent and Customers: For businesses, ESG is not just about attracting investors—it is also about appealing to consumers and talent. Companies that prioritize sustainability and social responsibility are increasingly favored by customers and employees, which can boost profitability and long-term success.

Tailored ESG Strategies for HNWIs and Corporations:

Pallas Wealth Management and JF Bicking & Co. offer customized ESG and impact investing strategies designed to help clients align their financial portfolios with their values. Whether through sustainable energy investments, socially responsible funds, or governance-focused initiatives, these strategies enable HNWIs and businesses to drive positive change while achieving their financial objectives.

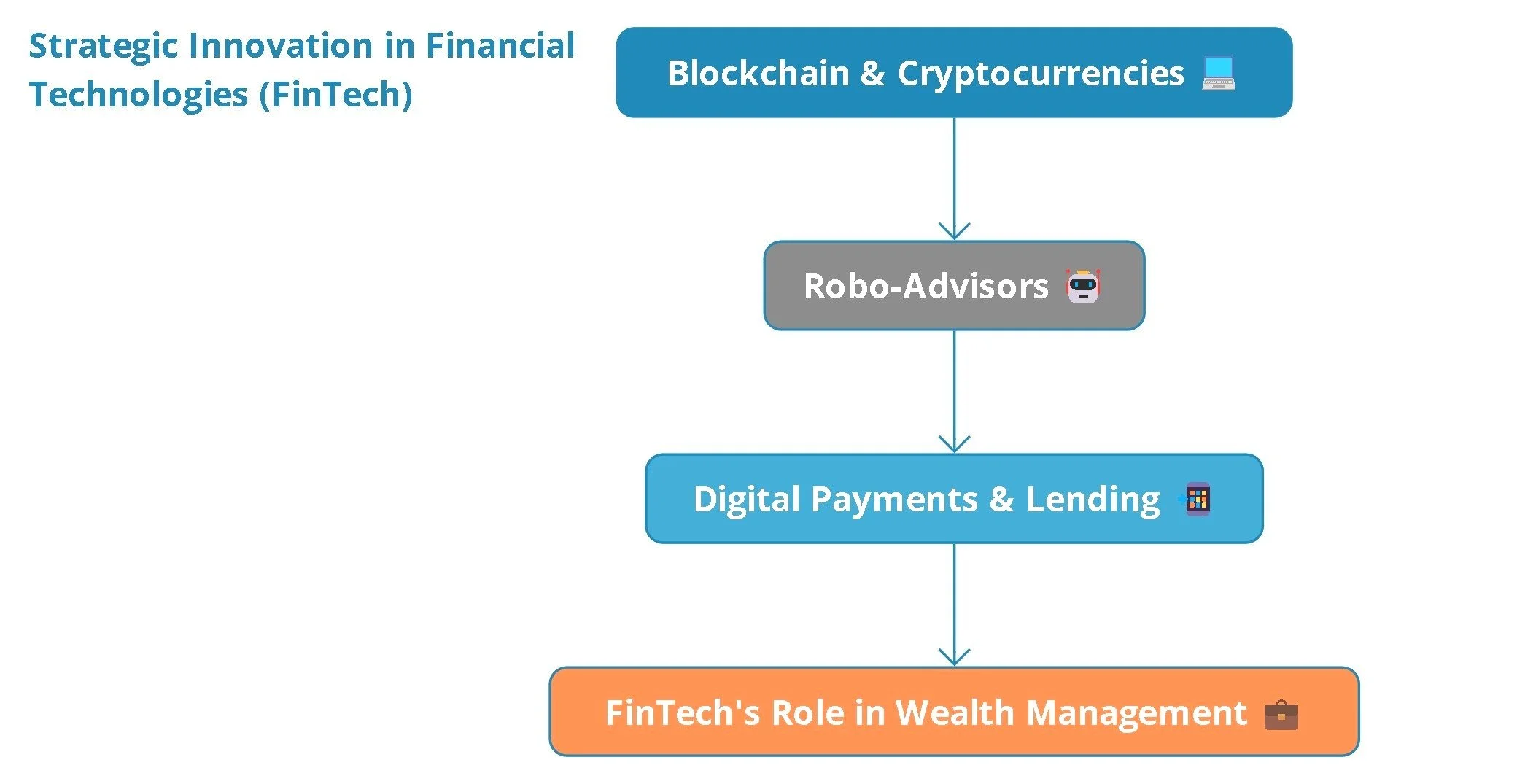

Strategic Innovation in Financial Technologies (FinTech)

FinTech as a Catalyst for Innovation in Wealth and Business Management

The rise of financial technologies (FinTech) has revolutionized how wealth is managed, how businesses operate, and how capital is allocated. The integration of technologies such as blockchain, AI-driven analytics, and automated investment platforms has reshaped the landscape for both individual investors and businesses alike.

Key Innovations in FinTech:

Blockchain and Cryptocurrencies: Blockchain technology has enabled the creation of decentralized financial systems that offer enhanced security, transparency, and efficiency. Cryptocurrencies such as Bitcoin and Ethereum have emerged as alternative investment vehicles, offering HNWIs opportunities to diversify portfolios with digital assets.

Robo-Advisors: AI-driven platforms known as robo-advisors are democratizing access to wealth management services by offering automated investment advice at a fraction of traditional costs. These platforms analyze data in real-time, optimizing portfolios based on market conditions and individual risk profiles.

Digital Payments and Lending Platforms: Digital payment solutions and peer-to-peer lending platforms are reshaping how businesses and consumers interact financially. Companies like PayPal and Stripe have transformed the e-commerce landscape, while lending platforms like LendingClub enable businesses to secure capital more easily.

FinTech’s Role in Wealth Management and Business Strategy:

FinTech innovations provide businesses and HNWIs with powerful tools to manage wealth and capitalize on investment opportunities more efficiently. JF Bicking & Co. and Pallas Wealth Management are at the forefront of helping clients leverage these technologies to optimize their financial strategies.

Conclusion

In an increasingly complex and unpredictable economic landscape, innovation and capital management serve as the twin pillars of long-term growth and sustainability. For both businesses and high-net-worth individuals, embracing digital transformation, pursuing strategic mergers and acquisitions, and adopting advanced wealth management techniques are critical steps in achieving financial success and resilience.

JF Bicking & Co. and Pallas Wealth Management provide comprehensive services that enable clients to navigate these challenges. By combining innovation-driven business strategies with tailored capital management solutions, they help clients not only survive but thrive in today’s dynamic environment.

The future of sustainable growth lies in the ability to adapt to new technologies, integrate socially responsible investment practices, and maintain a focus on long-term capital management. By leveraging the expertise of strategic advisory firms and wealth management professionals, businesses and HNWIs can create lasting value and make a positive impact on the world.

Appendices:

Glossary of Terms: M&A, ESG, AI, FinTech

Case Study: Digital Transformation Success in the Manufacturing Sector

References and Further Reading